Agree Technology Partners with Financial Innovation Ecological Laboratory to Explore Paths for Financial Innovation Development

Agree Technology Co., Ltd. (hereinafter referred to as ‘Agree Technology’ or ‘the Company’) is one of the most competitive and influential IT solution providers in the banking industry in China. With over 20 years of experience in software development, the company has focused on serving banks and financial institutions, providing consulting services, software development, operation and maintenance services, and other information services. Leveraging its industry-leading technological advantages and strong service awareness, Agree Technology has accumulated a large number of long-term cooperative clients in the banking IT solution market. The company has served approximately 200 clients, including state-owned large banks, nationwide joint-stock banks, city commercial banks, rural credit cooperatives, rural commercial banks, foreign banks, and other financial institutions. Its client base in the financial sector is extensive, earning a high brand reputation and good industry recognition. Furthermore, according to the latest industry reports, Agree Technology ranks among the top in the overall market for banking IT solutions in China, maintaining a leading position in the smart branch segment for several consecutive years. The company also possesses strong market competitiveness in several areas, including intermediary business, payment and clearing systems, remote banking, and open banking.

Agree Technology has long been committed to the independent research and development of core technologies for basic software platforms and the construction of innovation capabilities. It has developed a component-based technology platform, graphical development tools, and core operating platform engine technologies, forming a unique basic software platform, such as the Agree Financial Channel Cloud Platform (AB5) and Agree Financial Business Cloud Platform (AFA5), which support various solution products offered by the company. To date, the banking IT solutions provided by the company cover key business areas such as smart branches, intermediary business, payment and clearing, channel management, digital operation analysis, open banking, operation and maintenance monitoring, and technology management, creating a comprehensive solution portfolio that spans banking channels, business, and management.

While continuously enhancing its innovation capabilities and refining its products, Agree Technology actively participates in industry exchanges and expands its network of ecological partnerships. The Financial Innovation Ecological Laboratory, as a crucial driver of innovation in financial information technology, has established a close cooperative relationship with Agree Technology since its inception. Agree Technology has provided substantial support to the laboratory regarding personnel, technology, and equipment resources, actively participating in various exchange activities organised by the laboratory and earning high praise for its contributions. Several of the company’s products have successfully verified adaptation in the laboratory. The company’s independently developed ‘Intermediary Business Solution’, ‘Integrated Monitoring Platform Solution’, and ‘Unified Platform Project Solution for Self-Service Devices’ have all been included in the first batch of the laboratory’s published ‘Financial Innovation Solutions (First Batch)’. The company’s ‘Bank Counter System Solution’ has also been selected as part of the laboratory’s ‘Second Phase of Excellent Financial Innovation Solutions’. Moving forward, Agree Technology will continue strengthening its collaboration with the Financial Innovation Ecological Laboratory to promote the high-quality development of financial information technology innovation, jointly creating a new ecology and environment for financial information technology innovation.

Award Certification

Award Certification

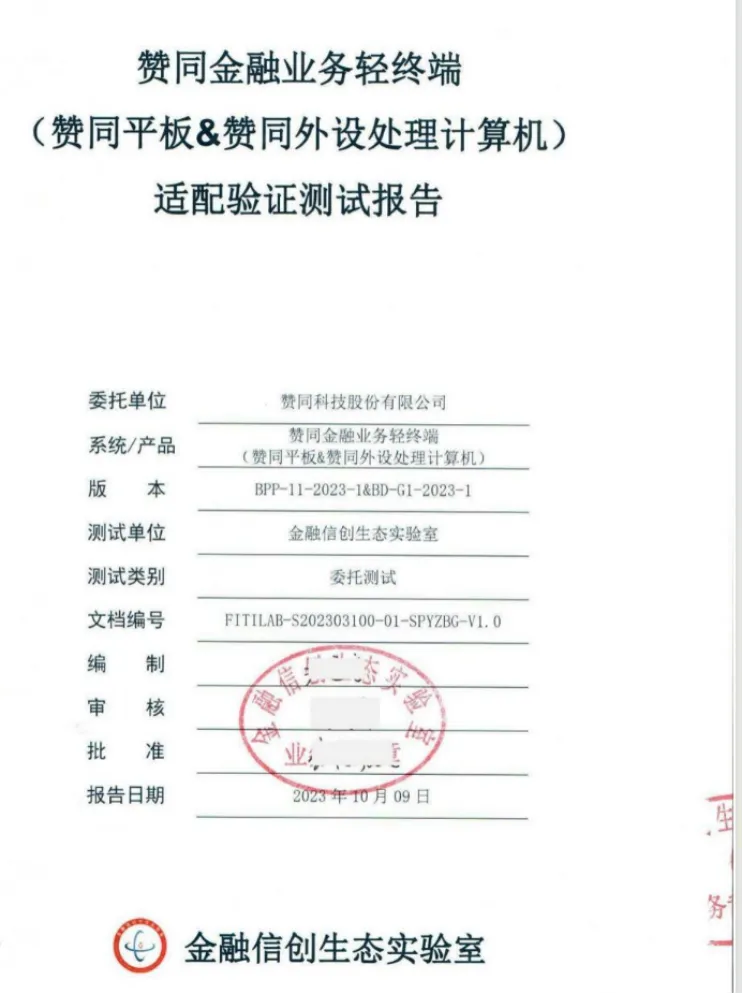

Test Report

Test Report

About the Laboratory

The Financial Innovation Ecological Laboratory was established to implement the national innovation-driven development strategy, led by the People’s Bank of China and spearheaded by China Financial Electronic Corporation. It involves collaboration among major financial institutions and industrial organisations, with participation from relevant units in the financial innovation ecology related to industry, academia, and research. The laboratory adheres to ‘consultation, construction, win-win cooperation, and sharing’ principles, focusing on essential infrastructures and specialised experimental platforms for financial innovation.

The laboratory maintains a goal-oriented and problem-oriented approach, gathering resources from multiple parties to address common issues in financial innovation. It aims to develop financial innovation solutions and implementation pathways, providing financial institutions with referenceable, replicable, and promotable guidelines and demonstrations. Additionally, it offers mechanisms and platforms for demand matching, product iteration, technical breakthroughs, and technological innovation to industry organisations, thereby promoting the establishment and improvement of the financial innovation ecosystem.